Chime is a user-friendly online bank account that allows you to transfer money quickly and easily between friends. One of the most attractive features of it is the fact that there are no fees, a huge bonus to anyone making regular payments from their online account. However, sometimes you need to access your money through a different account. There are so many different ones out there, but the one we're going to focus on in this article is Cash App. This is another widely used online payment system. Our guide for accessing money from Chime to Cash App is as follows:

- Open Cash App

- Access Your Profile in Cash App

- Select Add Chime Bank Account

- Login to Your Chime Bank Account

- Confirm that Everything Works

1. Open Cash App

All you need to do is open the Cash App application for now.

If you don't have the app on your mobile device, then you could also log in online via a desktop browser.

If you're doing this on a desktop computer, then you'll need to ensure that you're able to login before attempting to go any further.

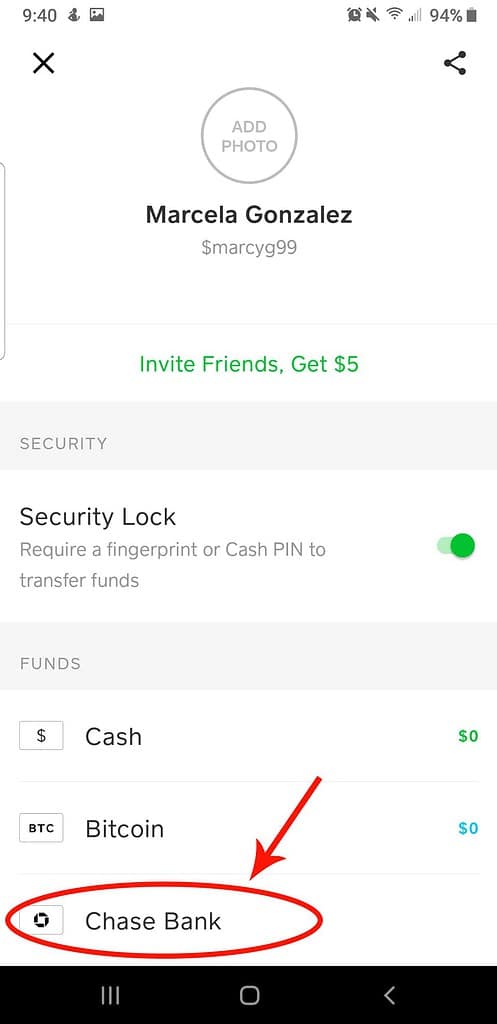

2. Access Your Profile in Cash App

In the Cash App application, you can access your profile by tapping your profile picture. This should bring you to your main account page. It will show you your balance, as well as any associated cards. You should also see some options for adding new cards and bank accounts.

On a desktop browser, you need to navigate to your profile, and you'll want to keep an eye out for the options to add new bank accounts here as well.

3. Select Add Chime Bank Account to Cash App

Now you'll need to add a new bank account to your Cash App application:

To do this, you need to click on the ‘Add Bank Account' option in your profile.

This will bring up a list of the various types of bank accounts that you can add. When you add your bank account to Cash App, you can transfer money to those accounts and request it from them as well.

This allows you to pull money from wherever you have it and pay it to your friends without needing to pay a fee as you do on Paypal or similar services.

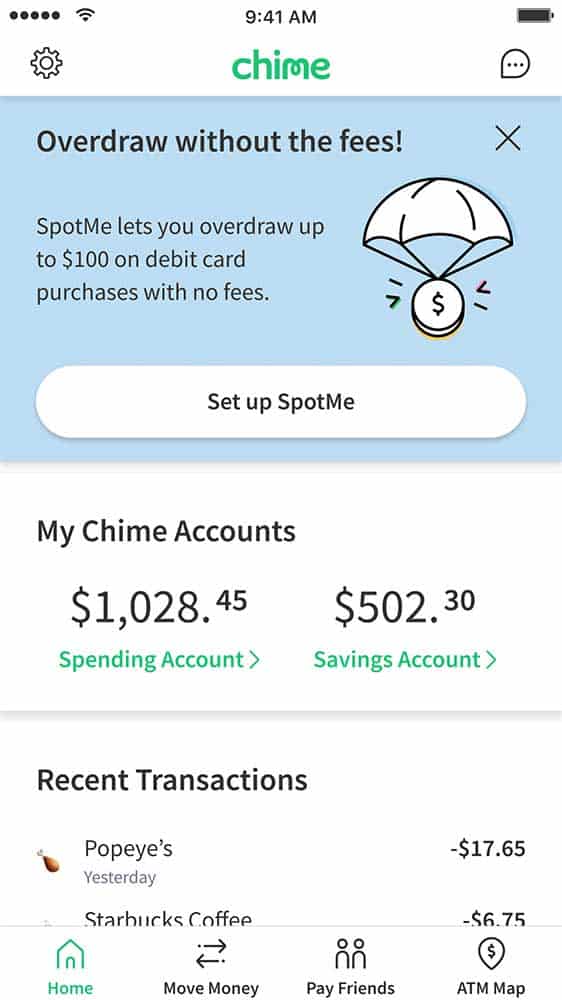

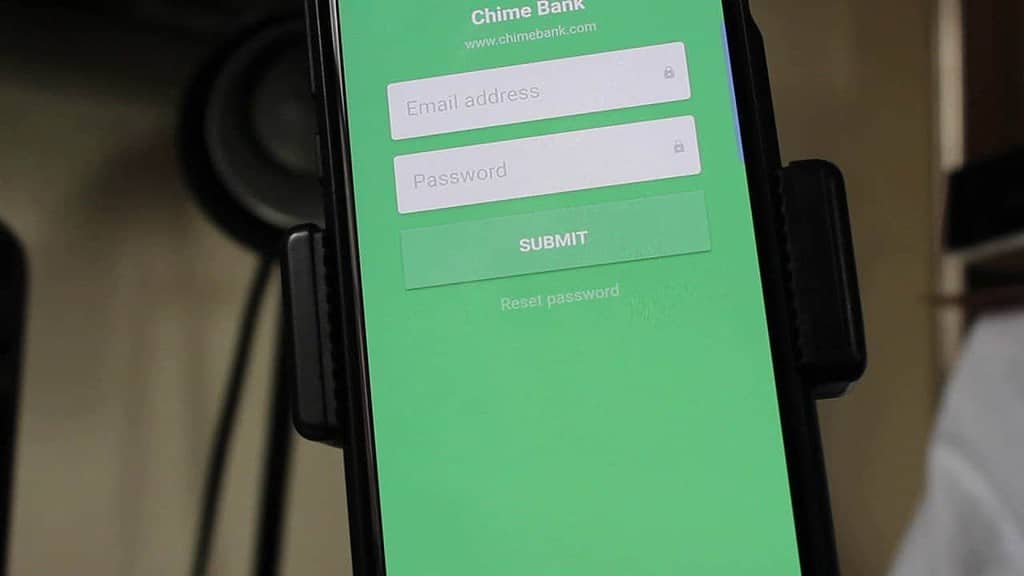

4. log in to Your Chime Account

Chime is one of the banks listed when you tap the ‘Add Bank Account' option in Chime. If you don't see it immediately, scroll down until you do. Once you've found it, you need to click on it. This will bring up a login screen.

Now that you have selected your Chime bank account, you'll need to login into your account in order to send money to it, or request money from it.

Ensure you get your details correct; otherwise, it might flag up some suspicious activity with Chime. When you've successfully logged in, you should see your Chime bank account listed on your profile page as one that you have access to.

5. Confirm That Everything Works

This step might seem unnecessary, but it's important. You don't know that Chime or Cash App will allow you to transfer money between the two without testing it.

Try transferring a small amount, say $1, from Chime to Cash App. Once the money has come through, try transferring it back to Chime from Cash App.

As long as these transfers work, you should be good to go the next time you need to put money in your Cash App from Chime.

Chime Debit Card

If you have a Chime bank account then you may know that you can also get a Chime debit card. This is a card that draws directly from your Chime account. You can even use it at ATMs. If you have a Chime debit card, then you can add this to your Cash App as well.

When viewing your profile in Cash App, there is an option to add cards to the account as well as bank accounts. If you click this, you can add any card that you own to your account.

All you need to do is type in all the required information, and you'll be able to use that card as a form of payment within the Cash App. This is a great alternative to using Apple Wallet and other payment applications because it acts as a card payment system and money transfer center in one. There's no need to deviate from Cash App; you can do it all in one place.

Chime doesn't make it very clear that you can add your account to Cash App. Instead, they like to focus on telling you to take out a savings account with them, or a debit card. However, as this guide demonstrates, it's entirely possible to add Chime to Cash App without much difficulty.

The one thing I will say about the relationship between Chime and Cash App is that it seems rocky when there are any issues. Cash App's customer service isn't keen to help users out when it comes to looking at transfers from Chime, so try to keep any transfers you make small. That way, you'll be able to stop transferring more if an issue occurs.

Comments

Post a Comment